How to Choose Which 1040 Form to Use

In either case at the top of page 1 of the corrected return enter CORRECTED in dark bold letters followed by the date. In most cases an amended Form 1040-SS or Form 1040.

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

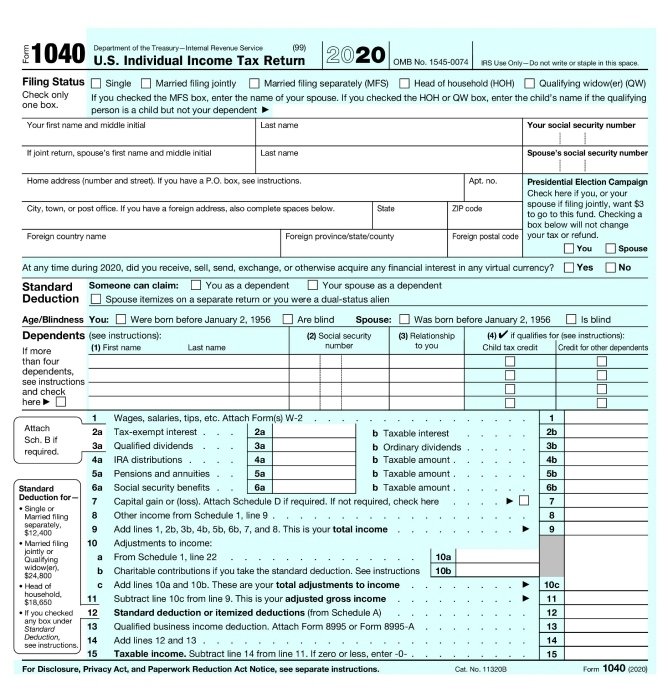

Form 1040 U S Individual Tax Return Definition

The Form 1040-ES package includes worksheets to help you account for differences between the previous and current years income and calculate the tax you owe.

. The form calculates the total taxable income of the taxpayer and determines how much is to be paid or refunded by the government. By the time you fill in your name address and Social Security number youre almost halfway there. Free Federal return tax preparation and e-file.

File a new Form 1040-SS to change a Form 1040-SS you already filed. Income tax returns for individual calendar year taxpayers are due by Tax Day which is usually. Schedule A Form 1040 or 1040-SR is an IRS form for US.

To figure out if you should file 1040-ES for the current year make the following calculation. The advantages of Form 1040A or 1040EZ is they are easy to fill out and easy to read. For tax year 2017 the program supports the 1040 1040-A and 1040-EZ Forms.

Take the tax you paid in the previous year. In tax year 2018 the IRS indicated there would only be one 1040 form for all filing needs due to the new Tax Reform changes. If you filed Form 1040-SS but should have filed Form 1040 file a corrected return on Form 1040.

If you have a question about a form while preparing your Free File Fillable Forms return always refer to the Instructions For This Form which is displayed as a button for all the forms at lower part of the screen. All taxpayers complete their original filing on one of these two forms. Calculate 90 percent.

Who should file 1040-ES. Thats the beauty of Free File Fillable Forms. Seniors who choose to use Form 1040-SR enjoy the benefits of larger fonts larger deductions and schedules that account for their unique financial situations.

If amendments are necessary a taxpayer can file amendments using Form 1040-X. Taxpayers who choose to itemize their tax-deductible expenses rather than take the standard deduction. Form 1040 officially the US.

The program will automatically determine whether you qualify to use the 1040-SR Form or the 1040 Form based on your entries. Which IRS form to use. Individual Income Tax Return is an IRS tax form used for personal federal income tax returns filed by United States residents.

You can always use Form 1040 regardless of whether you qualify to use Form 1040A or 1040EZ. Form 1040EZ for example is a one-page form. The program will.

Printable Irs Form 1040 For Tax Year 2020 Cpa Practice Advisor

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Comments

Post a Comment